This is a great question. This really doesn’t qualify as “autotrading”. But it does use the Conditional Order wizard that was demonstrated in that video.

As I understand your question, you want to create an order to purchase a Collar With Stock. And then you want to condition the execution of that order upon the price of the Call minus the price of the Put being greater than or equal to 0.35. We need to cover a few important items before we get into the solution.

Practice:

Be sure to practice this technique using the PaperMoney side of Thinkorswim BEFORE entering an order with live money. Not only that, but once you are ready to trade in your live account, start small and build up to whatever level you are seeking. Remember that execution on PaperMoney may vary greatly from the live market.

Liquidity:

The execution quality will be extremely challenged if the Options Open Interest and Daily Volume are limited. The example listed below is EXTREMELY illiquid. I only chose it because the debit price of the example is close to what is listed by the question’s author.

Limit versus Market Orders:

For the order that executes the Collar With Stock, you will have the option of setting it as a limit or a market order. Understand the condition we place on the order merely sets a trigger the causes the order to entered, not executed. If you use a Market order you are very likely to get an immediate execution, but your price is out of your control. If you use a Limit order you are assured of your price but the order may not execute while your condition is still true!

Ok, I hope that covers the big stuff. I really don’t want anyone damaging their account, so please take these considerations to heart.

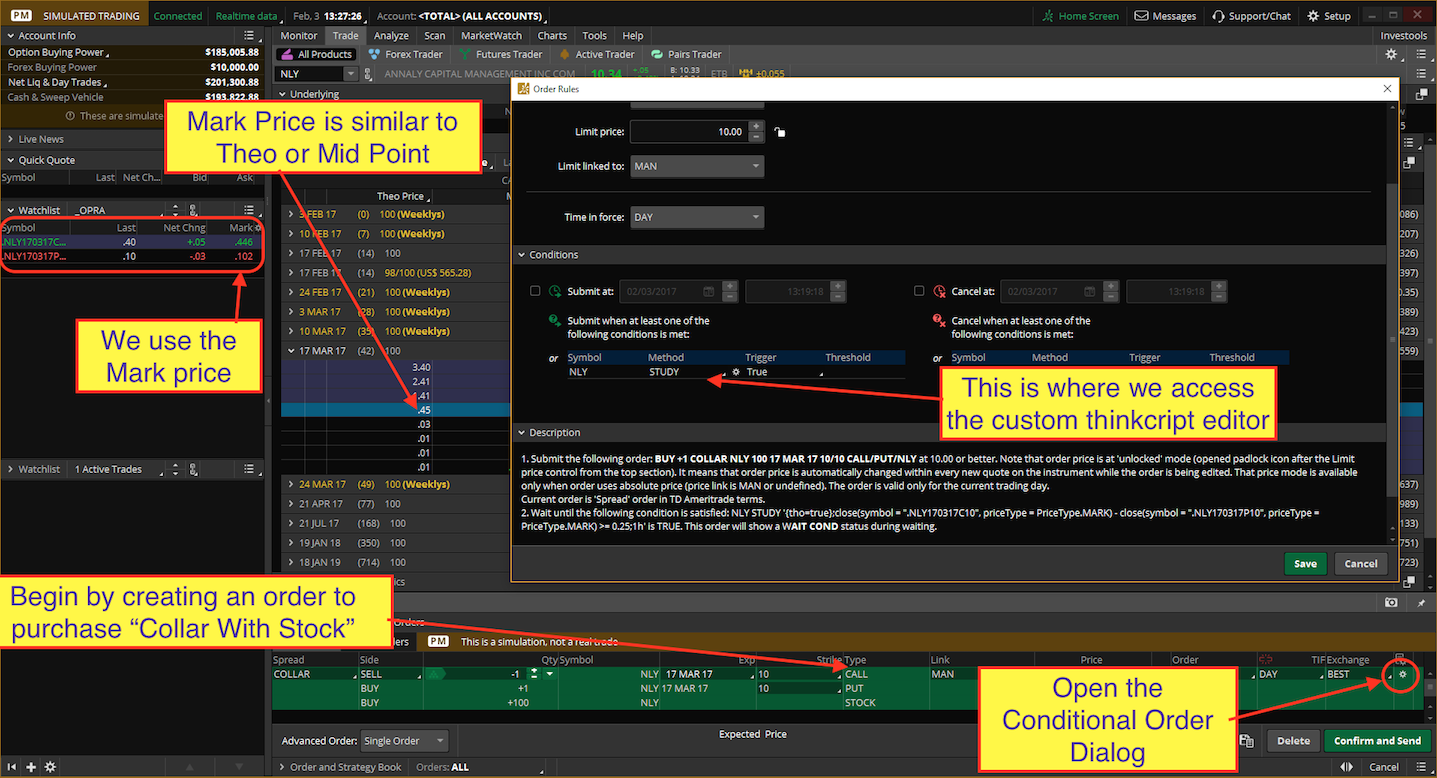

The screenshots are commented to explain the different components. I tried to condense things into a brief form. It is assumed that you have already viewed our videos that demonstrate how to use the Condition wizard. It is also assumed that you are already very familiar with placing orders for complex spreads on the Thinkorswim platform.

Thinkorswim AutoTrade Almost

Thinkorswim Alert Ichimoku

The steps are:

- Enter a stock symbol and open an option chain. Select a strike price and create a Collar With Stock order.

- Open the Conditional Order Wizard and create a custom study condition (watch the videos)

- Delete any existing conditions and access the Thinkscript editor

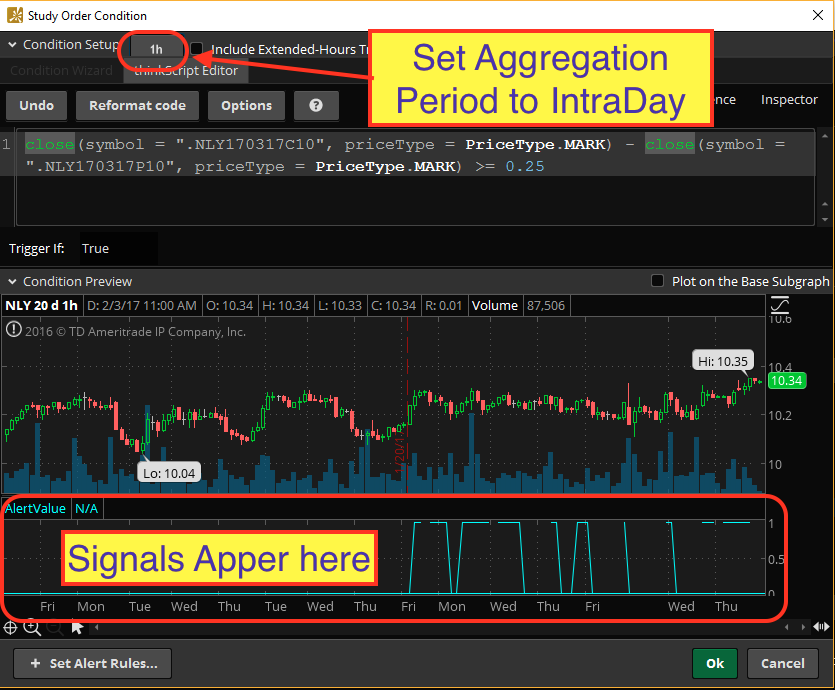

Enter the Thinkscript into the editor. I have provided an example that is based on stock ticker NLY and a strike price of 10. This code takes the Mark price of the Call and Subtracts the Mark price of the Put. You must enter the two OPRA codes inside the quotation marks. At the end of the statement is a test, in this case greater than or equal to 0.35. You should adjust this to fit your particular case.

close(symbol = ".NLY170317C10", priceType = PriceType.MARK) - close(symbol = ".NLY170317P10", priceType = PriceType.MARK) >= 0.35

These are for the March 2017 monthly expiration. Depending when you are viewing this, these options may have already expired. So be sure to substitute your own OPRA codes. Where do I get the OPRA codes??? Yes, great question. When viewing an option chain, simply right-click over the Call or Put side of the strike price you want. The menu that pops up has an option for “Copy.NLY170317C10”, (in the case of this example). Yours will have a different OPRA code after the word “Copy”.

Ok, I think that should cover it. Please be sure to up-vote any questions that best solve your question. And let us know if you need clarification on any of these points.