| ♥ 0 |

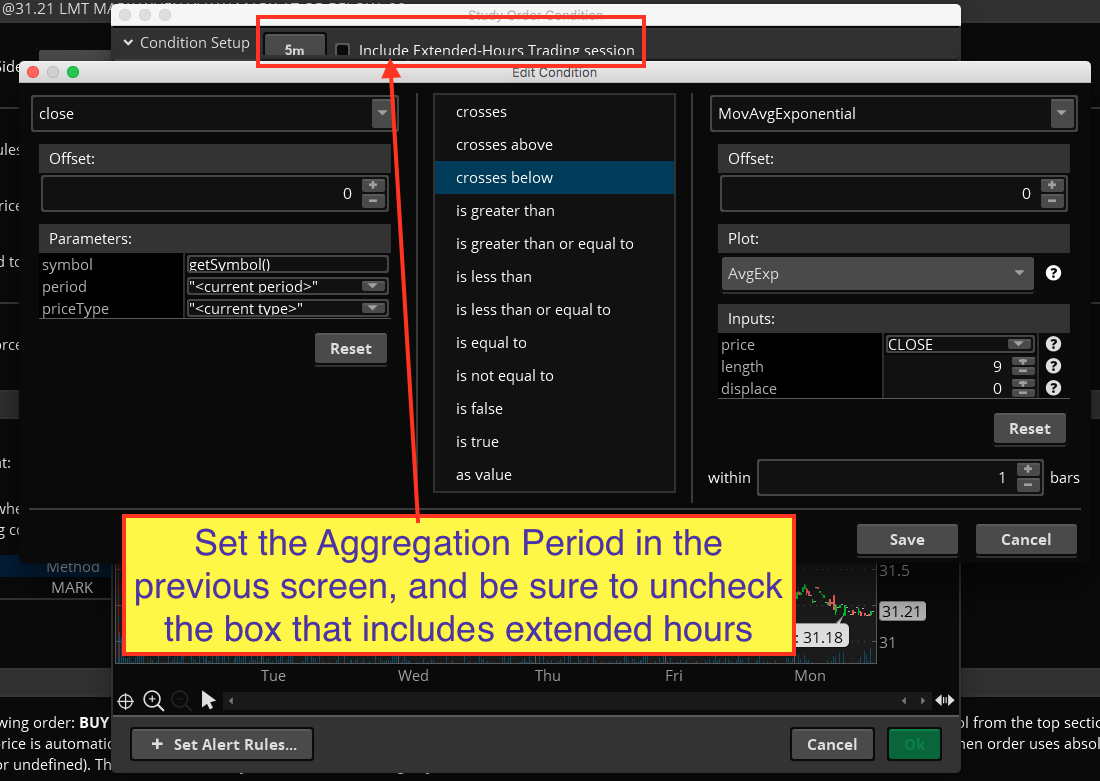

I need to have orders execute once stocks from my watchlist meet certain conditions for the day. Buy when: Stock price is above yesterday’s high and the current 5-minute candle is green. Sell (the stock we just bought) when: The current 5-minute candle closes below the 9 exponential moving average. )

Marked as spam

|

|

Private answer

I don’t know what the heck happened there and it won’t let me edit it, “curr5-minutenute.” Lol. I just meant 5-minute. Marked as spam

|

|||||||||||

|

Private answer

The tool we can use in Thinkorswim to automatically execute trades is called a “Conditional Order”. The techniques for using this are explained in great detail in our video titled “Thinkorswim AutoTrade Almost“. Your specifications are relatively simple to implement and you should be able to build it yourself using the condition wizard (no code writing required). The part of your specification that cannot be achieved on the Thinkorswim platform is to have a set of rules apply to a list of stocks. The rules must be manually applied to each individual stock, applying the Conditional Order to each. You can set them to automatically regenerate after being triggered. After viewing the video, spend some time practicing until you become familiar with the tools. If you still need assistance building the condition statement to match your specifications just leave a comment to this answer and we’ll post something for you. Marked as spam

|

|||||||||||

|

Private answer

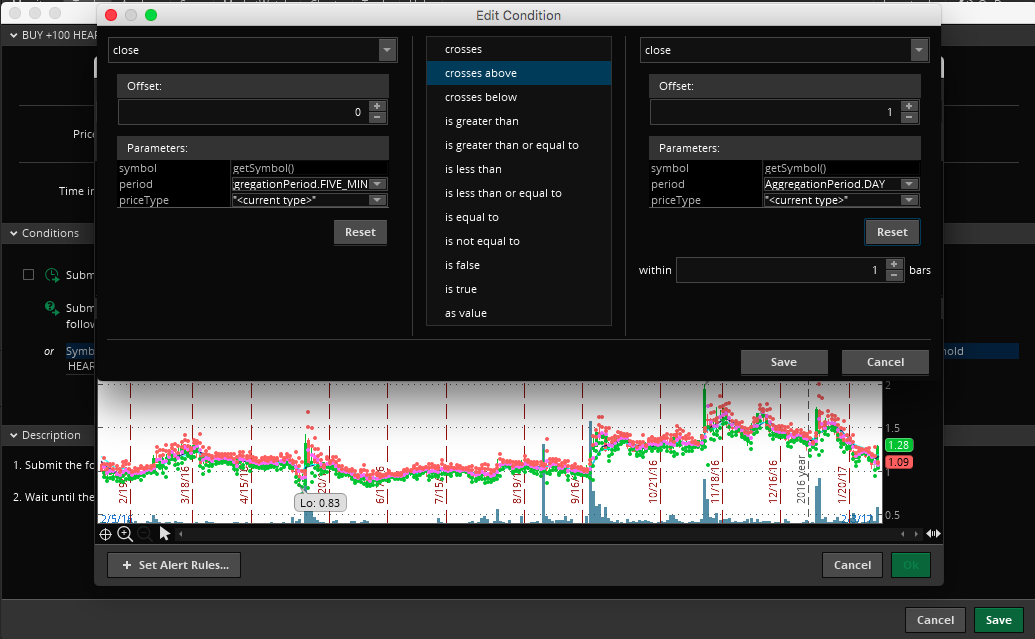

I am having trouble… It won’t let me press ok in the condition wizard, it keeps saying “Secondary period cannot be less than primary.” I put: close(“period” = AggregationPeriod.FIVE_MIN) crosses above close(“period” = AggregationPeriod.DAY) from 1 bars ago

Marked as spam

|

|||||||||||

|

Private answer

I'll work on a response to this Monday morning. Marked as spam

|

|||||||||||

|

Private answer

In response to the follow-up comments I will add the following details. To the question about refining the buy condition to make sure prices are coming up and crossing above the previous day’s high. You would need to do this on an intraday time frame, so we’ll take the 5 min as per your example. Since we cannot reference the daily time frame from the 5 min time frame, we need to use recursion to record and retain that value into the next day. Here is the code that works on any intraday time frame to record the highest high from the pervious day and carry that value into the next trading day:

The problem we run into is that recursion is not supported in Conditional Orders or Study Alerts. You can only use this in Watchlists, Scans, and Chart Studies. There is no work around. You will not be able to code your buy condition into the conditional order editor. Go head and copy and paste this and check out the error messages. Ok, so now on to your exit condition. At least we may be able to automate the exits. That all depends on that 9 period EMA you are using. You ask for a way to code a condition for when the 5 min candle crosses below the “9 EMA”. Is that the 9 period EMA on the 5 minutes time frame? Or is the 9 period EMA using some other time frame? If it is using the 5 min time frame, then you can build this directly in condition wizard. See screenshot below for details. Marked as spam

|

Please log in to post questions.

I took care of the edit for you.