| ♥ 0 |

Hi Pete, can you please make a scan that finds stocks closing over the lower 1 standard deviation at least 3 consecutive times settings would be: num dev dn: -1.0 (this one being the lower standard deviation) num dev up: 1.0 length: 20 day

Marked as spam

|

|

Private answer

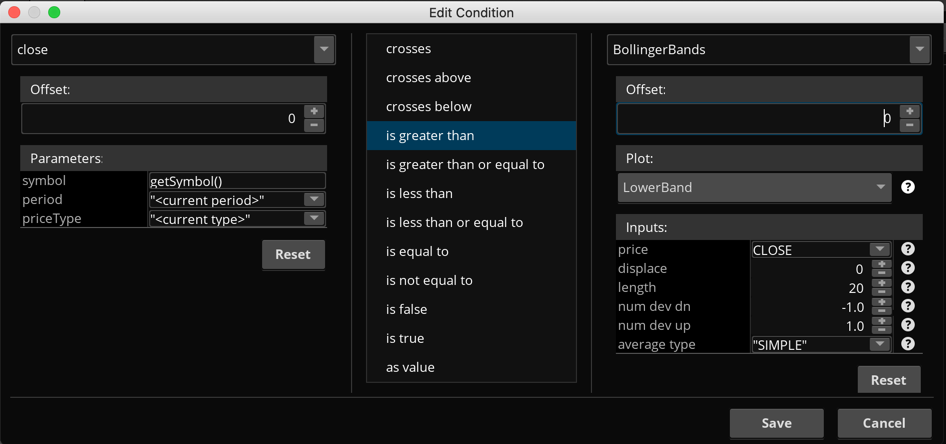

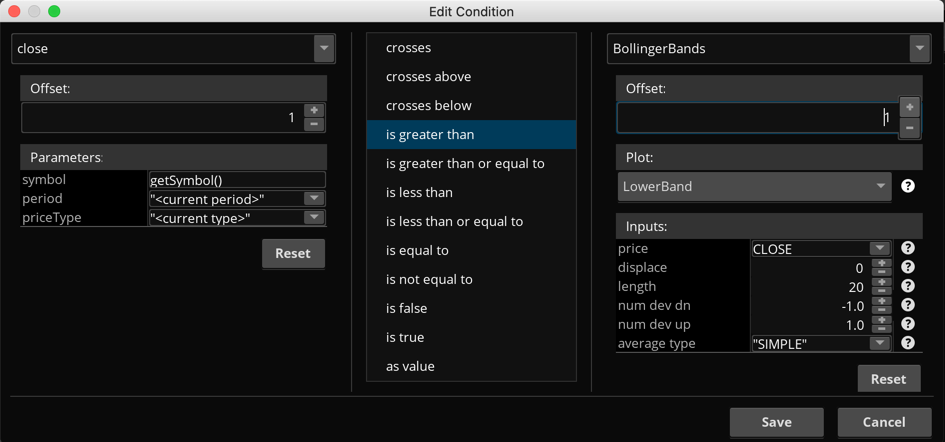

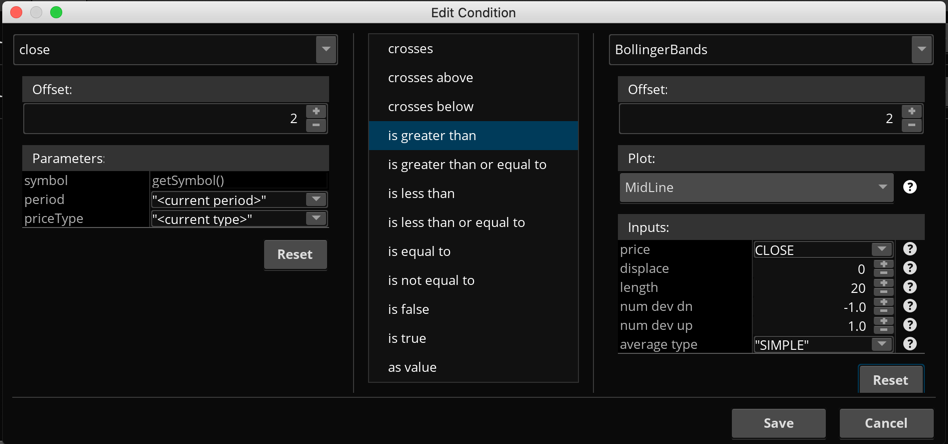

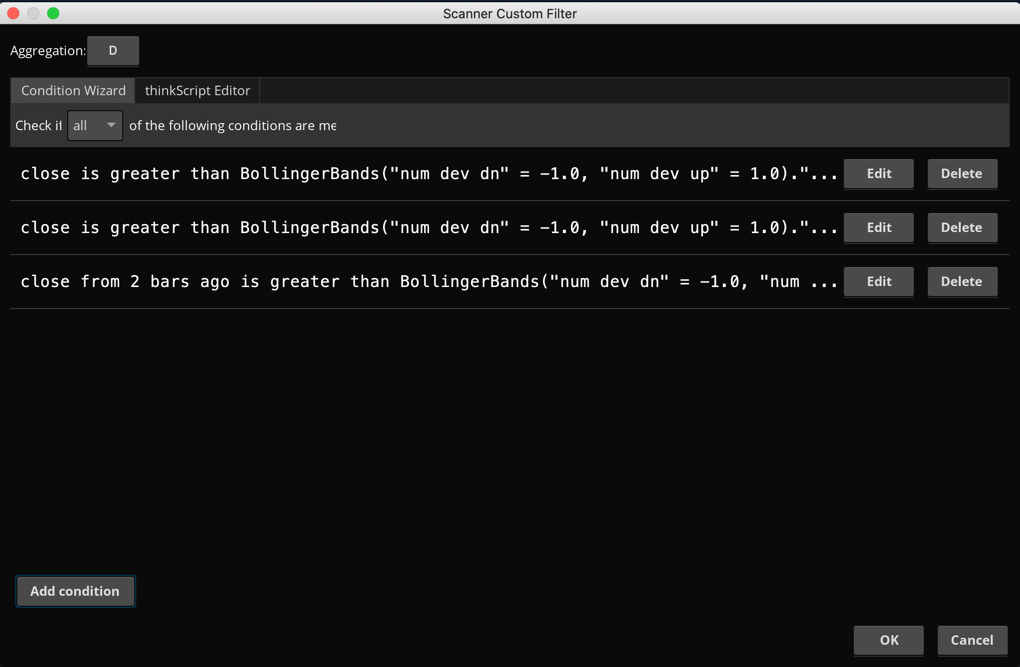

Ok, after a few clarifications in the comments section above I have a solution. The question title has been updated to include the name of the chart study. This was omitted in the original question which is why I had to request clarifications. This scan requires absolutely no custom code whatsoever. Anyone can build this scan with just a few clicks of the mouse. How? By using the Condition Wizard: https://www.hahn-tech.com/thinkorswim-condition-wizard/ After viewing that free tutorial video you will understand how to read the screenshots below. These screenshots show each of the steps required to complete the construction of this custom scan. Marked as spam

|

Please log in to post questions.