Hi Pete

Thank you for the reply. I didn’t know this was an index that was set up by the platform and it is not something you can write a code for and make it an indicator. It is good to know the difference thanks again for the information.

In regards to the usefulness of the index itself I have to strongly disagree with you. By any means this is not a day trading tool but it is very useful if you are a swing trader. I do trade momentum stocks for a living. I hold anytime from 2-days to a few weeks. The tool helps me determine the best time to push on the gas and take breakouts on strong stocks, this is true when the tool is below 20. It al so tell me when the move is getting extended and I should tighten my stops on open positions.

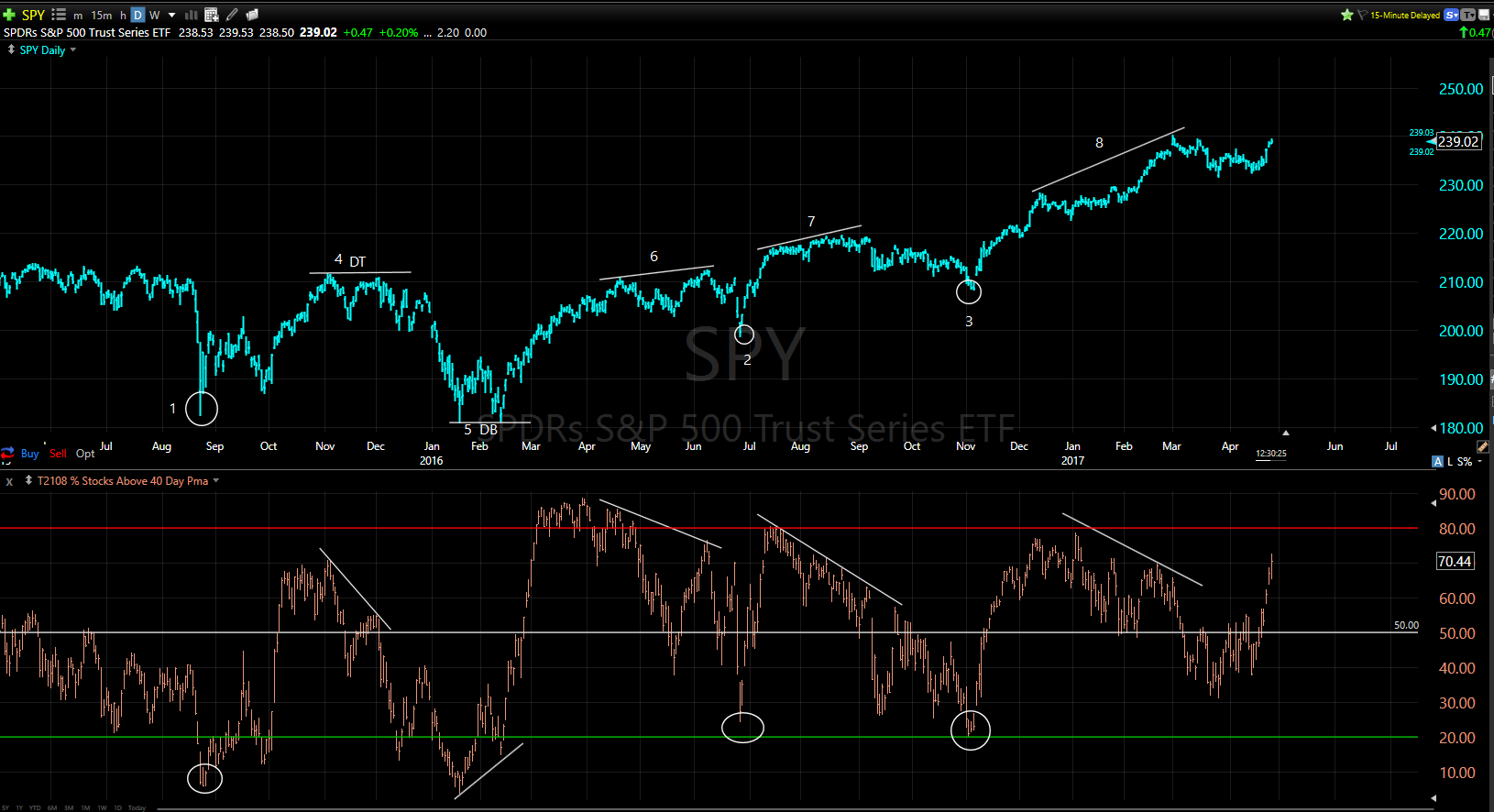

Please see the below chart of over a year of data, I marked how I use the tool and its applications for swing trading. Also as information from anyone reading your blog.

1 August 2015 the index was below zero for a few weeks. This was the time to scan for strong stocks that were consolidating near 52-week highs or fighting the overall market correction.

2 The index didn’t make it all the way to 20 but it came close. Same concept keep a close eye on strong stocks consolidating near highs.

3 The index touch 20 just before reversing. The point is every time the index goes below 20 or near 20 it is overdone on the downside and the odds are high a rally it is just around the corner. Therefore it is the time to pay close attention to stocks consolidating near highs because this stocks will be the first to rocket to the upside once the market has bottomed.

4 SPY formed a double top while index shows a strong bear divergence. Tighten stops on open positions and take profits on stocks that are way extended from the 20-day ma.

5 SPY Double Bottom while index was not only below 20 but also formed a bullish divergence. Great buying opportunity for the whole year.

6 SPY moving higher, index negatively diverging. sell extended positions and tighten stops.

7 and 8 same as 6.

Probably another great example of why I am not a profitable trader. I did a quick Google search and found there are other versions of this published by various entities.

Here is one that I found: http://www.indexindicators.com/charts/nyse-vs-nyse-stocks-above-50d-sma-params-3y-x-x-x/

Hahn-Tech, LLC has no affiliation to this site and cannot vouch for it’s accuracy or efficacy. Use at your own risk.