| ♥ 0 |

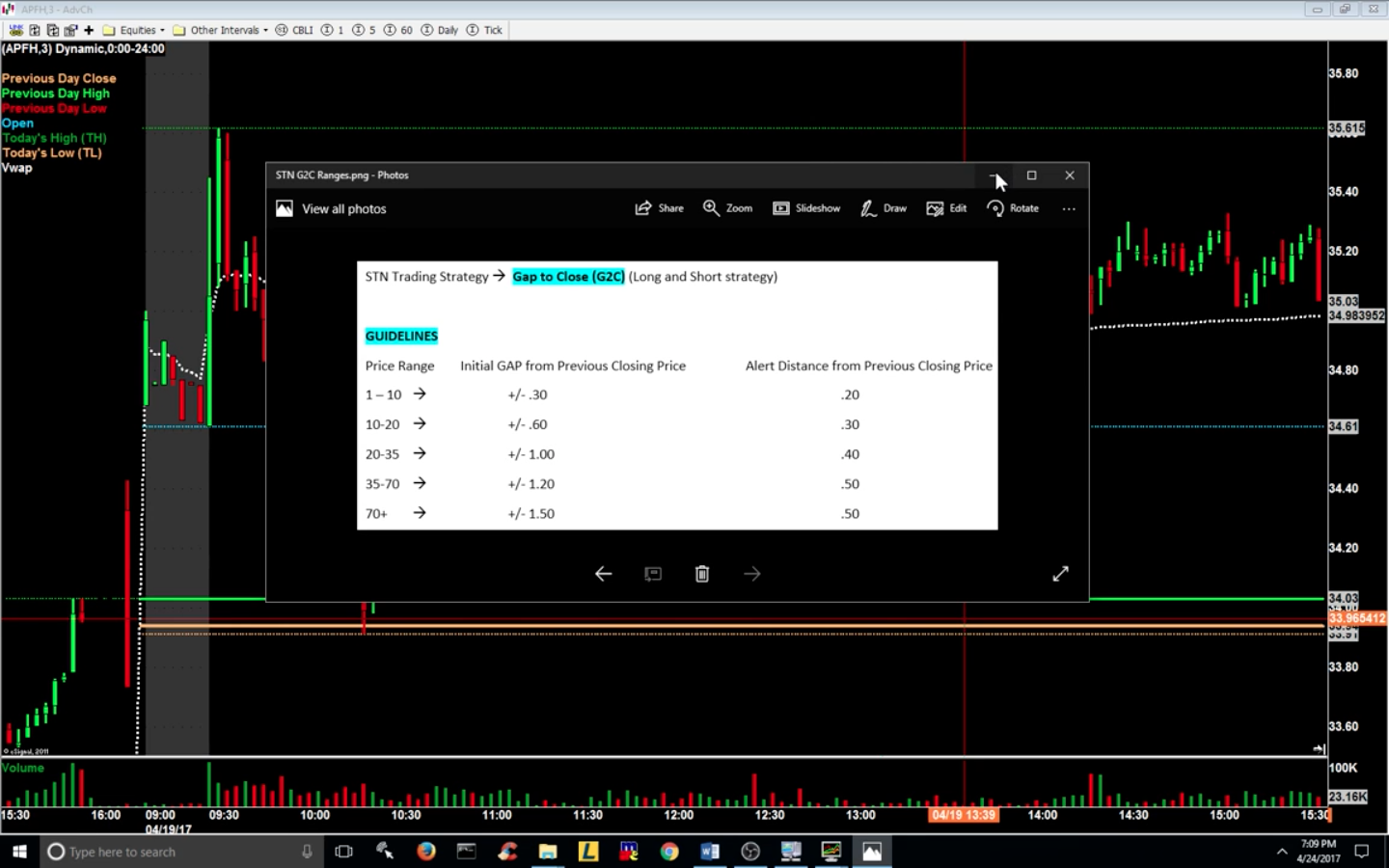

Hello everyone! I believe this could be easy but I am having trouble creating/modifying a script/scan that looks for stocks that meet the following criteria. Equities that Gap up, reverse to PDClose AND/OR Gap down, reverse to PDClose. The setup is stronger the closer PDC is to days HIGH or LOW S/R level. The attached image guidelines/metrics are used to determine which stocks meet G2C requirements. PT is 50% fib retrace. Pete – i really enjoyed your overnight range scan alert tutorial (was the range breakout video completed?) Your videos and enthusiasm have opened my eyes to the potential of TOS script. You make it look easy, the learning curve is steep so I really appreciate your efforts and helpful community. Thank you! RESOLVED

Marked as spam

|

|

Private answer

Thanks for provide a very clear description and including a screenshot for reference. Give this code a spin and let me know what you get. I tested it just a little bit and it seems to give results that you are requesting. But I don’t actually trade this so it’s up to you to give it a thumbs up or not. (hope the text formatting here doesn’t break the code structure. you might have some touching up to do)

Marked as spam

|

|||||||||||||||||||||||||||||||||

|

Private answer

Pete, Thank you very much! I have had a lot of fun playing with your code today and analysing results. The code works very well and i’d like to run by you a couple of observations so i understand how this works, and behaves. I’m excited to see how this works during the trading session. I have attached two images. Image 1) Displays scan results (>500k vol) in a watchlist with 4 charts. 2 Left side results Gap Up and Right side 2 Gap Down. Gap Up (left side) look good. My first impression’s the Gap Down charts were providing errors since the setup near PDC was no-longer True. That said the Setup was True shortly after Open. Am i correct in thinking the scan keeps True results throughout the trading day even when the setup is no longer True? Image 2 displays my 2nd observation, a chart of CLVS with HL and PDC levels drawn. Clearly this would have been a great trade but i’ve struggled to adjust the code parameters to pick up CLVS in scan results. Hoping you know what I’m missing. Looking forward to further tests and analysis. Thank you and regards, Marked as spam

|

Please log in to post questions.

Pete – probably best to ignore my below findings until i’ve given more time to test/learn how to use this script during market hours – when it counts. Getting different results now that the market is open offering conflicting observations. Have a great day.